By: Robert J. Nahoum

Why new‑car prices are pushing used‑car prices up

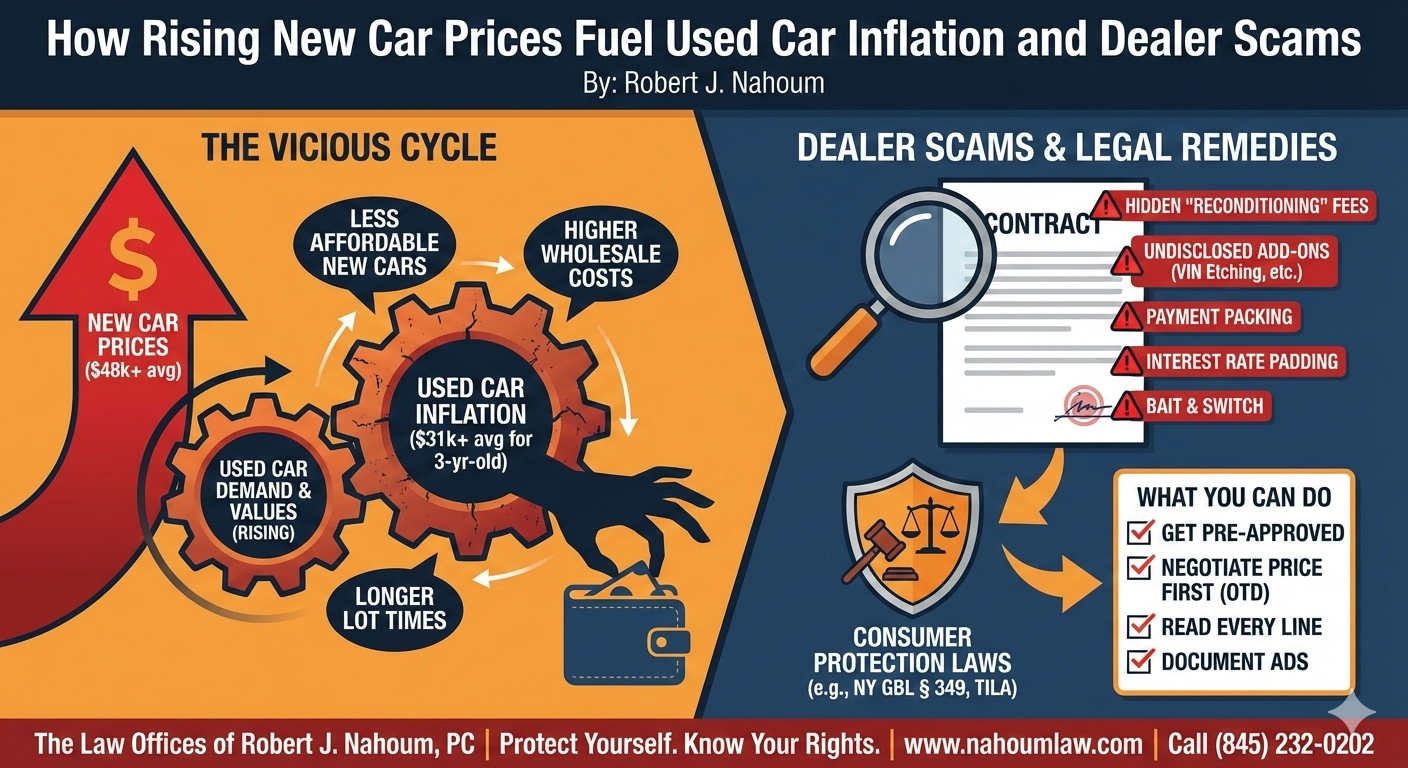

New‑vehicle prices have climbed sharply in recent years, with the average new‑car transaction price now well above $48,000 in 2025, according to industry data. As new cars become less affordable, more consumers are turning to the used‑car market, which in turn drives demand and lifts wholesale and retail used‑vehicle values.

Edmunds’ 2025 used‑car insights report notes that the average transaction price (ATP) for three‑year‑old vehicles reached about $31,000 in the third quarter of 2025, up roughly 5% year‑over‑year, even as vehicles sit on dealer lots longer. NPR and other outlets similarly report that “soaring” new‑car prices have “pushed the prices for [used vehicles] up, too,” making many mid‑range used cars feel like mini‑luxury purchases.

How this environment encourages dealer abuse

When margins on the vehicle itself are compressed or when buyers are stretched thin, some dealers look to finance and add‑ons to make up the difference. In this climate, some dealers also surreptitiously increase the sale price by bundling trade‑in value and purchase price into a single number, or by adding undisclosed “reconditioning” or “market adjustment” fees at the finance desk.

Common tricks consumers should watch for

Several recurring patterns appear in recent news and FTC‑style alerts:

- “Payment‑focused” negotiation: Dealers steer you to talk about monthly payment instead of total price or interest rate, then stretch the loan term or inflate the rate to pad profits.

- Unwanted add‑ons slipped into the contract: Tire protection, key‑fob insurance, VIN etching, and “protection packages” appear in the final paperwork even though you never explicitly agreed to them.

- Interest‑rate padding: Dealers obtain a lower buy‑rate from the lender but quote you a higher rate, pocketing the spread.

- Bait‑and‑switch advertising: Online ads show low prices on specific vehicles, only for the salesperson to claim the car is “sold” and steer you to a more expensive model with hidden fees.

The FTC has stressed that dealers cannot charge you for add‑ons you did not want or agree to, and that many of these extras are optional, not required.

What consumers can do to protect themselves

If you are shopping for a used car in today’s inflated market, consider these steps:

- Get pre‑approved elsewhere: Secure financing from a credit union or bank before visiting the dealership so you can compare the dealer’s rate and avoid being locked into padded interest.

- Negotiate price first, then financing: Focus on the total purchase price and out‑the‑door (OTD) cost before discussing monthly payments.

- Read every line of the contract: Check for add‑ons you did not request and ask for them to be removed; if the dealer refuses, walk away.

- Document advertised prices: Take screenshots of online ads so you can challenge bait‑and‑switch pricing or “market adjustments” that were not disclosed.

Legal rights and remedies for auto‑fraud victims

New York and federal consumer‑protection laws give buyers tools to fight deceptive auto‑dealer practices. Under statutes such as the New York General Business Law § 349 (prohibiting deceptive acts and practices) and the Truth in Lending Act (TILA), consumers may be able to challenge:

- Hidden or inflated fees added at the finance desk.

- Unauthorized add‑ons or “payment packing” that distort the true cost of the loan.

- Bait‑and‑switch advertising or misrepresentations about vehicle condition, warranty coverage, or required products.

If you believe a dealer has surreptitiously increased your sale price, packed your contract with unwanted products, or misrepresented terms, you may have grounds for a claim under consumer‑protection and contract law. The Law Offices of Robert J. Nahoum, P.C. regularly represents consumers in disputes involving deceptive auto‑dealer practices, breach of contract, and unfair sales tactics; more information about our practice can be found on our consumer protection page.

For a free consultation about an auto‑fraud or deceptive‑sales issue, contact us at our Hudson Valley office or our Brooklyn location.

📞 Call (845) 232‑0202 or visit our contact page: www.nahoumlaw.com/contact