By: Robert J. Nahoum

Short Answer

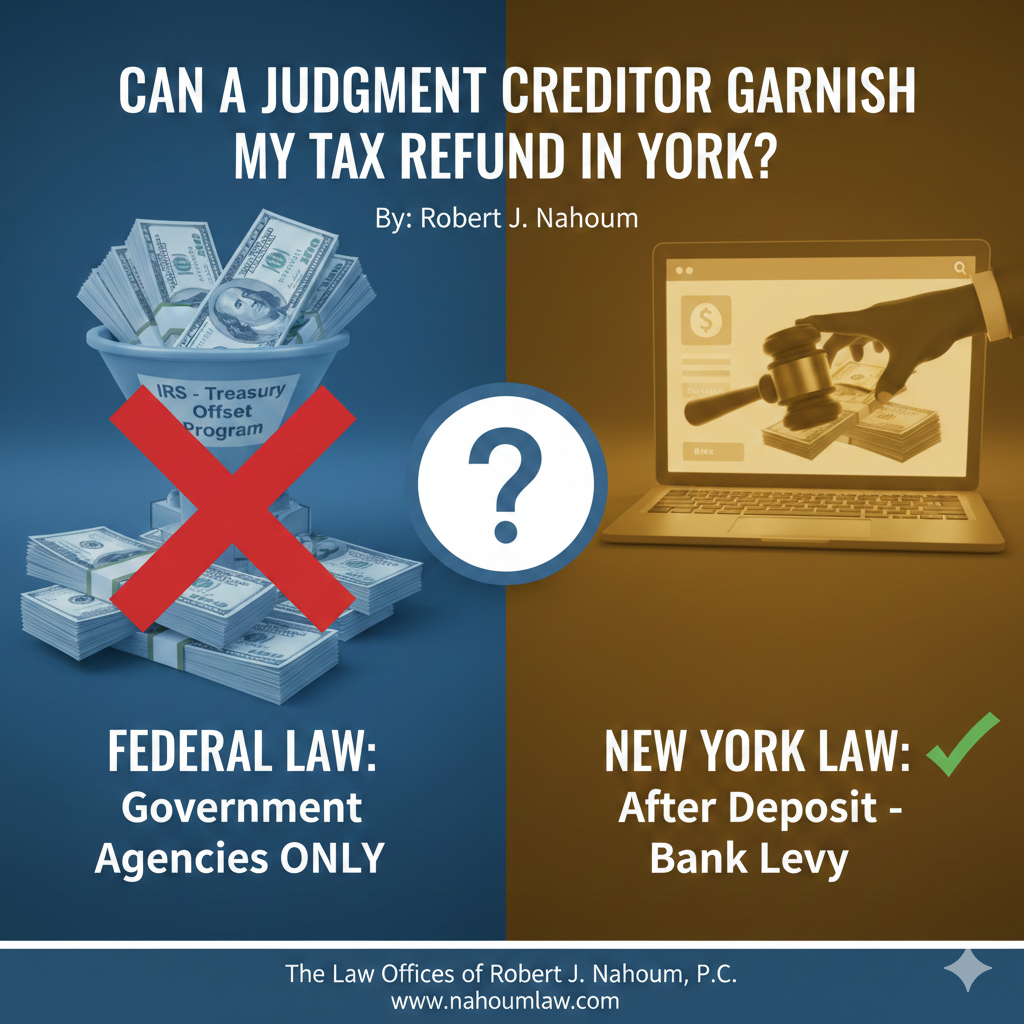

A private judgment creditor with a New York judgment cannot intercept your federal or New York State tax refund directly, but once that refund is deposited into your bank account it can generally be restrained and levied like other non‑exempt funds, subject to New York’s exemption rules and special protections for certain government‑related “emergency relief” refunds.

Federal Law: Who Can Take a Tax Refund?

Under federal law, only certain federal and state government agencies can intercept (or “offset”) a federal income tax refund before it is issued.

- The U.S. Department of the Treasury’s Treasury Offset Program (TOP) allows offsets of federal income tax refunds to pay specific government debts, such as past‑due federal taxes, federal student loans, state income tax, child support, spousal support, and certain unemployment overpayments.

- Private judgment creditors and debt collectors—for example, credit card companies, debt buyers, medical providers, and their collection lawyers—do not have direct access to your federal tax refund through TOP and cannot instruct the IRS to send your refund to them.

In other words, a New York judgment alone does not allow a private creditor to have the IRS or U.S. Treasury route your refund straight to the creditor. The only entities that can do that are the limited government creditors participating in the Offset Program.

New York Law: Judgment Enforcement Against Bank Funds

Once a federal or state tax refund is paid to you and deposited in your bank account, it generally becomes like any other money in the account and is subject to New York’s judgment‑enforcement procedures, including restraining notices and levies, unless an exemption applies.

Under New York’s Article 52 of the Civil Practice Law and Rules (CPLR):

- A judgment creditor can use restraining notices and executions to freeze and then take non‑exempt funds in a debtor’s bank account.

- New York’s Exempt Income Protection Act, mainly CPLR §§ 5222, 5222‑a and 5205, exempts certain categories of funds from restraint and levy, including Social Security benefits, public assistance, pensions, disability benefits, and a portion of recent wages; the debtor must usually assert these exemptions promptly with an exemption claim form.

- New York also protects specific emergency‑relief tax refunds and credits—including certain federal COVID‑era stimulus refunds and refundable credits—by making them exempt from application to a money judgment. CPLR § 5205(p) provides that “payments to individuals, including tax refunds, recovery rebates, refundable tax credits, and any advances of any tax credits” under various federal relief acts are exempt from satisfaction of a money judgment.

Outside those special categories, a tax refund that has become ordinary funds in your account can be frozen and levied by a judgment creditor who has a valid New York judgment and complies with Article 52 procedures.

Practical Distinction: Direct Garnishment vs. Bank Levy

For consumers, the key distinction is between:

- Direct interception of the refund (before you see it):

- Only certain government agencies, through Treasury’s Offset Program, can do this with your federal refund. Private New York judgment creditors cannot file anything with the IRS or Treasury to redirect your refund to them.

- Enforcement after deposit (once the refund is in your account):

- Once you receive the refund and either cash it or deposit it into a bank account, New York judgment‑enforcement law treats it like any other non‑exempt asset, subject to bank restraining notices, executions, and exemption claims.

This is why you might hear that “creditors can’t garnish your tax refund” and, at the same time, see people lose a tax refund after it hits their bank account to a New York levy.

Special Protections for Certain Tax Refunds

New York offers additional protections for specific tax‑related payments that grew out of federal COVID‑19 relief legislation. CPLR § 5205(p) exempts from execution:

- Certain federal tax refunds, recovery rebates, refundable tax credits, and advances paid under the Families First Coronavirus Response Act, the CARES Act, the Consolidated Appropriations Act of 2021, and the American Rescue Plan Act of 2021.

These emergency‑relief‑related payments remain protected from application to a money judgment, although debtors should still assert the exemption if their bank account is restrained.

By contrast, ordinary federal or New York State income tax refunds that are not within one of these protected categories are generally not automatically exempt once deposited, and a New York judgment creditor can reach them through normal bank enforcement tools.

How The Law Offices of Robert J. Nahoum, P.C. Can Help

If a debt collector or judgment creditor is targeting your bank account after you receive a tax refund, you may have exemption rights under New York law and may also have claims under state or federal consumer‑protection statutes if the collector has overstepped.

The Law Offices of Robert J. Nahoum, P.C. represents New York consumers who are sued by debt collectors and who are facing judgment enforcement, including wage garnishments and bank restraints. You can learn more about our consumer protection and judgment enforcement work and contact us through our website at https://www.nahoumlaw.com.

The Law Offices of Robert J. Nahoum, P.C. defends consumers across New York in debt collection cases.

Contact us today at (845) 232-0202 or visit www.nahoumlaw.com for a free consultation.

Disclaimer: This post provides general information and does not constitute legal advice. Laws regarding minimum wage and exemptions are subject to change; always consult with an attorney regarding your specific case.