By: Robert J. Nahoum

Under 23 NYCRR § 1.4, “substantiation of a debt” means the debt collector must supply written documentation proving that the consumer actually owes the charged‑off debt and that the collector has the right to collect it. While the rule only applies to “charged‑off” consumer debts, in practice many collectors follow similar procedures when any consumer disputes a debt.

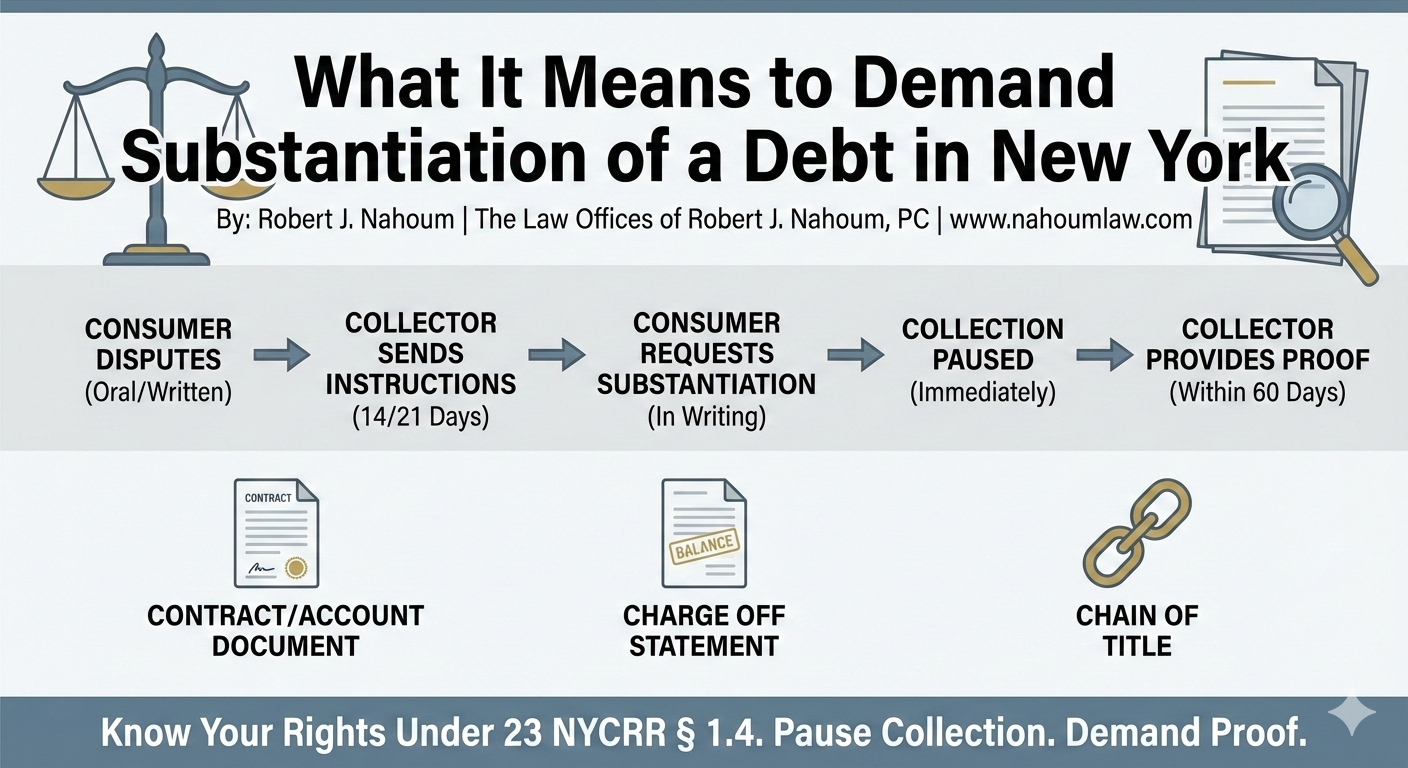

To trigger these rights, the consumer must dispute the validity of the charged‑off debt or the collector’s right to collect it, either orally or in writing. Once that happens, the collector has affirmative duties to inform the consumer of the substantiation right and, if requested, to gather and send the required documentation within strict timelines.

What documents the collector must provide

When a consumer requests substantiation of a charged‑off debt, the collector must provide a package of documents that collectively prove the debt and the chain of ownership. The regulation allows flexibility if a traditional signed contract is not available, but it still requires concrete documentation connecting the consumer to the account and the present owner.

Substantiation must include:

- Contract or account document. The signed contract or signed application that created the debt, or, if that does not exist, a document provided to the consumer while the account was active showing that the consumer incurred the debt; for revolving credit, the most recent monthly statement with a purchase, payment, or balance transfer is enough for this element.

- Charge‑off statement. The charge‑off account statement, or an equivalent document, issued by the original creditor that reflects the balance when the debt was charged off.

- Chain of title. A statement describing the complete chain of title from the original creditor to the current creditor, including the date of each assignment, sale, or transfer.

- Prior settlements. Records showing the amount and date of any prior settlement agreement entered after the effective date of the regulations.

The collector must also retain proof of the consumer’s substantiation request and all documents provided in response until the debt is discharged, sold, or transferred.

Key timelines and how they work

New York’s substantiation rule builds in multiple timelines, starting from the consumer’s dispute and continuing through the collector’s response. These deadlines govern when the collector must send instructions, when it must provide proof, and when it must pause all collection activity.

- If the consumer disputes orally, the collector has 14 days to send written instructions on how to request substantiation.

- If the consumer disputes in writing, the collector has 21 days to send written instructions on how to request substantiation (if it treats the dispute as separate from a request).

- Once the collector receives a substantiation request, it must provide written substantiation within 60 days.

- Collection efforts must stop on the charged‑off debt from the time the request is received until written substantiation is mailed or otherwise provided to the consumer.

- The collector only has to substantiate a charged‑off debt once while it owns or has the right to collect that account.

Timeline chart of operative deadlines

The following chart summarizes the key operative timelines under 23 NYCRR § 1.4 for charged‑off consumer debts.

| Event / Trigger | Deadline / Timeframe | What the Collector Must Do | |

| Consumer disputes validity of a charged‑off debt orally | Within 14 days of the oral dispute | Send clear, conspicuous written instructions telling the consumer how to request substantiation of the debt in writing. | |

| Consumer disputes validity of a charged‑off debt in writing | Within 21 days of receiving the written dispute | Send clear, conspicuous written instructions telling the consumer how to request substantiation of the debt. | |

| Consumer submits a written substantiation request (after a dispute) | Immediately upon receipt | Collector must cease all collection of the charged‑off debt until written substantiation is provided. | |

| Time allowed to provide written substantiation after receiving the request | Within 60 days of receiving the request | Provide full written substantiation (contract or equivalent, charge‑off statement, chain of title, and settlement records). | |

| Obligation to substantiate the same charged‑off debt while collector holds it | One time per collector per charged‑off account | After one complete substantiation, the collector is not required to substantiate again while it owns or has rights to the debt. | |

| Record‑keeping after substantiation requested | Until debt is discharged, sold, or transferred | Maintain evidence of the consumer’s request and all substantiation documents sent to the consumer. | |

Practical takeaways for New York consumers

Demanding substantiation of a debt in New York is a strategic way for consumers to pause collection and force proof that the debt is valid and collectible. If the collector cannot assemble the required documentation within 60 days, it cannot lawfully resume collection activity on that charged‑off debt until proper substantiation is provided.

Consumers should make substantiation requests in writing, keep copies, and send them in a way that provides proof of delivery so they can enforce the 60‑day deadline and the requirement that collection cease in the meantime. Where the paperwork reveals gaps in the chain of title, questionable balances, or prior settlements, those issues can become defenses or leverage in any future negotiation or litigation over the debt.

If you need help settling or defending a debt collection lawsuit, stopping harassing debt collectors or suing a debt collector, contact us today to see what we can do for you. With office located in Brooklyn and the Hudson Valley, the Law Offices of Robert J. Nahoum defends consumers in debt collection cases throughout the Tristate area including New Jersey.

The Law Offices of Robert J. Nahoum, P.C

(845) 232-0202

www.nahoumlaw.com

info@nahoumlaw.com