By: Robert J. Nahoum

Why EFTA Timelines Matter

Under the Electronic Funds Transfer Act (EFTA) and Regulation E, strict timelines control when consumers must report unauthorized electronic transfers and how quickly banks must investigate and resolve those disputes. Missing these deadlines can shift thousands of dollars of loss from the bank onto the consumer. Understanding these timelines is critical for both protecting your money and enforcing your rights when a bank fails to follow the rules.

Consumer Deadlines After Unauthorized Transfers

When an unauthorized electronic fund transfer appears on a checking, savings, debit card, or similar account, several key consumer deadlines apply.

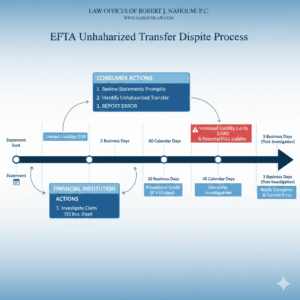

- 2 business days after learning of loss/theft of an access device (like a debit card): Reporting within this period caps liability at the lesser of $50 dollars or the amount of unauthorized transfers before notice. If the consumer waits more than 2 business days but reports within 60 calendar days of the bank’s statement, liability can increase up to $500 dollars for transfers before notice.

- 60 calendar days after the bank transmits the statement showing the first unauthorized transfer: The consumer must report an unauthorized transfer within 60 days of the statement date to avoid liability for additional transfers that occur after that 60‑day window. If the consumer fails to notify the bank within 60 days, liability for unauthorized transfers that occur after the 60‑day period can be unlimited.

These deadlines run from two distinct triggers: the date the consumer learns of loss/theft of an access device and the date the financial institution transmits the periodic statement reflecting the first unauthorized transfer.

Bank Investigation and Recredit Deadlines

Once the consumer gives timely notice of an error or unauthorized transfer, the financial institution’s own timelines begin.

- 10 business days to investigate: The bank generally has 10 business days from receiving a notice of error to investigate and determine whether an error occurred. If the unauthorized transfer occurred within 30 days after the first deposit into a new account, the institution may have up to 20 business days to complete the initial investigation.

- Provisional recredit and 45/90‑day extension: If the bank cannot finish within the initial period, it may take up to 45 calendar days (or up to 90 days for point‑of‑sale, foreign, or new‑account transactions) if it provisionally recredits the consumer’s account within 10 business days and gives the consumer full use of those funds during the investigation.

- One business day to correct and three business days to explain: If the bank determines an error occurred, it must correct the error, including appropriate interest, no later than one business day after its determination. If the bank determines no error occurred, it must mail or deliver an explanation of its findings within three business days and provide copies of the documents it relied on upon request.

Failure by the financial institution to follow these timelines can expose it to liability, including actual damages, statutory damages, and attorney’s fees under the EFTA.

Protecting Consumers Against Financial Deception

If you need help recovering money lost to an impersonation scam, contact us today to see what we can do for you. With offices located in Brooklyn and the Hudson Valey, the Law Offices of Robert J. Nahoum represents consumers in cases throughout the Tristate area including New Jersey.

The Law Offices of Robert J. Nahoum, P.C

(845) 232-0202

www.nahoumlaw.com

info@nahoumlaw.com