By: Robert J. Nahoum

If you’ve been sued and a debt collector and a judgment has been against you, that judgment allows the debt collector to garnishee wages , freeze your bank accounts and levy on your non-exempt property including your home or other real property.

In New York, the lien on real property is a passive method for enforcing a judgment meaning that the only step the debt collector needs to do to create the lien is to file the judgment in the county where the property is located. Once this done, the lien is in place and your property cannot be sold until the judgment is satisfied.

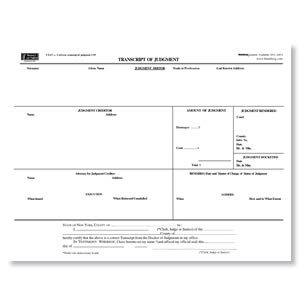

If you own property in a New York county other than the county in which the judgment was awarded, the judgment creditor must file the judgment with the county clerk in the other county in order to prefect the judgment lien. This process is calling “transcribing†the judgment and is accomplished by filing a “transcript of judgment†with the county clerk. The transcript of judgment is a simple one page document that provides the clerk’s office with the particulars of the parties and the judgment.

A judgment lien on real property is initially enforceable for ten years but can be extended for an additional 10 years. All the while the judgment accrues interest at 9% per year. For this reason, this passive means of judgment enforcement can be very costly for a judgment debtor home owner.

A judgment lien on real property is initially enforceable for ten years but can be extended for an additional 10 years. All the while the judgment accrues interest at 9% per year. For this reason, this passive means of judgment enforcement can be very costly for a judgment debtor home owner.

If you need help settling or defending a debt collection law suit, stopping harassing debt collectors or suing a debt collector, contact us today to see what we can do for you. With office located in the Bronx, Brooklyn and Rockland County, the Law Offices of Robert J. Nahoum defends consumers in debt collection cases throughout the Tristate area including New Jersey.

The Law Offices of Robert J. Nahoum, P.C

(845) 232-0202

www.nahoumlaw.com