By: Robert J. Nahoum

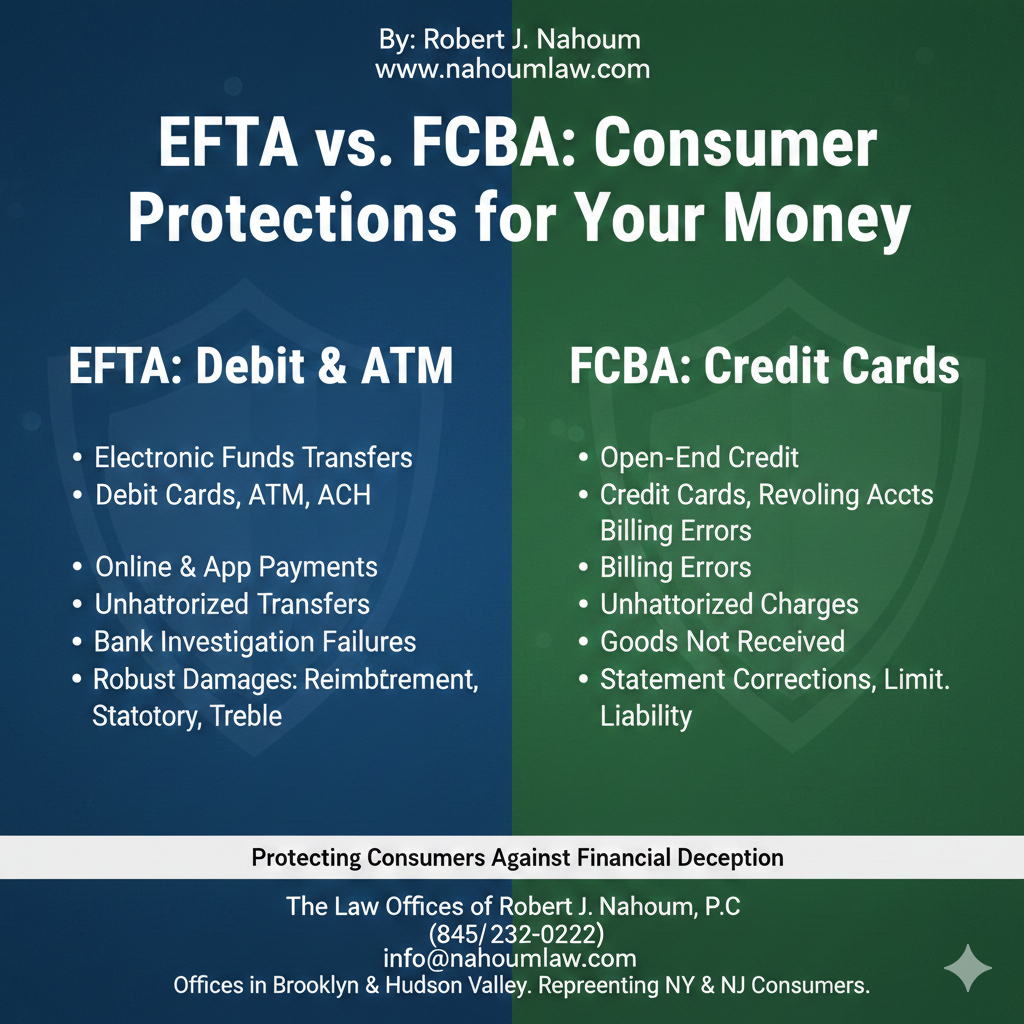

The Electronic Funds Transfer Act (EFTA), 15 U.S.C. §1693 et seq., governs electronic transfers from consumer bank accounts, including debit‑card, ATM, online banking, and app‑based transfers. The Fair Credit Billing Act (FCBA), 15 U.S.C. §1666, governs “open‑end” credit accounts, such as credit cards, and provides a dispute process for billing errors and unauthorized charges.

What the EFTA Covers

The EFTA and Regulation E protect consumers when money is pulled electronically from a personal bank account, typically through:

- Debit‑card purchases and ATM withdrawals.

- ACH debits, online banking transfers, and telephone‑authorized transfers from a deposit account.

- Peer‑to‑peer and app‑based payments that move funds electronically out of a consumer account.

Business accounts, paper checks, many wire transfers, and pure credit‑card transactions fall outside EFTA’s core coverage.

When banks fail to investigate timely reported unauthorized EFTs, refuse to recredit stolen funds, or ignore disclosure and timing rules, EFTA provides a private right of action in federal court. You discuss these claims in more detail in “Electronic Funds Transfer Act Timelines: Deadlines for Consumers and Banks After Unauthorized Transfers”.

What the FCBA Covers

The FCBA amends the Truth in Lending Act and applies to open‑end credit accounts, primarily credit cards and similar revolving accounts. It is aimed at “billing errors,” a term that includes:

- Unauthorized charges on a credit‑card account.

- Wrong amounts, duplicate charges, or charges for goods not received or not as described.

- Failure to properly credit payments or post them timely.

To invoke FCBA protections, a consumer generally must send a written billing‑error notice to the creditor within 60 days of the statement on which the error first appeared. The creditor then must acknowledge the dispute within about 30 days and resolve it within two billing cycles (but no more than 90 days), during which the consumer may withhold payment of the disputed amount without collection or adverse credit reporting.

Key Differences Between EFTA and FCBA

Covered accounts and transactions

- EFTA:

Applies to consumer deposit accounts and electronic transfers, including debit‑card, ATM, ACH, and app‑based withdrawals. - FCBA:

Applies to open‑end credit accounts, including credit cards and some home‑equity or retail charge accounts, but not debit cards or installment loans.

Type of problem addressed

- EFTA:

Focuses on unauthorized electronic fund transfers, bank failure to investigate or correct errors, and violations of disclosure and timing duties under Regulation E. - FCBA:

Focuses on billing errors on credit accounts, including unauthorized charges, misposted payments, charges for undelivered or defective goods, and other statement inaccuracies.

Notice deadlines and procedures

- EFTA notice:

Consumers must report unauthorized EFTs “as soon as possible,” and liability limitations change if notice is given within 2 business days, after 2 but within 60 days, or after 60 days of the statement. Your EFTA timelines article breaks down how missing a deadline can shift the entire loss to the consumer. - FCBA notice:

Consumers must mail a written billing‑error notice within 60 days of the first statement containing the disputed charge. The creditor has strict deadlines to acknowledge and resolve the dispute, during which it cannot collect or report the disputed amount as late.

Forum and enforcement

Both laws allow private lawsuits and are enforced by federal agencies (such as the CFPB and FTC), but the claims differ in elements and proof. In practice, your firm often litigates EFTA claims in tandem with state‑law consumer‑protection statutes, contract claims, and negligence, especially in New York and New Jersey.

Damages Under the EFTA vs. FCBA

Damages under the Electronic Funds Transfer Act

EFTA provides robust remedies when a financial institution fails to meet its obligations:

- Reimbursement of unauthorized transfers and fees (return of stolen funds, overdraft fees, and related charges).

- Actual damages for losses caused by the violation, such as cascade overdrafts, late fees on other accounts, and sometimes emotional distress where permitted.

- Statutory damages of $100–$1,000 per individual lawsuit, even without proving actual damages.

- Treble (triple) damages when the institution willfully fails to comply with error‑resolution deadlines or provisional‑credit obligations.

- Attorney’s fees and costs for prevailing consumers, making it feasible to pursue smaller‑dollar cases.

- Class‑action damages capped at the lesser of $500,000 or 1% of the defendant’s net worth.

Damages under the Fair Credit Billing Act

FCBA remedies are structured differently:

- Correction or removal of billing errors and adjustment of the consumer’s account if the dispute is successful.

- Limitation of liability for unauthorized credit‑card use, typically capping liability at $50 and often effectively at zero in practice.

- Protection from collection efforts and negative credit reporting on the disputed amount while the creditor investigates, so long as the consumer properly disputes the charge.

Because FCBA operates as an amendment to the Truth in Lending Act, available damages often track TILA’s framework, including actual and statutory damages and attorney’s fees in appropriate cases, but the main day‑to‑day “relief” most consumers experience under FCBA is correction of the statement and prevention of cascading late fees, interest, and credit‑report damage.

Protecting Consumers Against Financial Deception

If you need help recovering money lost to an impersonation scam, contact us today to see what we can do for you. With offices located in Brooklyn and the Hudson Valey, the Law Offices of Robert J. Nahoum represents consumers in cases throughout the Tristate area including New Jersey.

The Law Offices of Robert J. Nahoum, P.C

(845) 232-0202

www.nahoumlaw.com

info@nahoumlaw.com