By: Robert J. Nahoum

Portfolio Recovery Associates, LLC — often known simply as PRA — is one of the nation’s largest junk debt buyers. The company purchases old consumer debts from original creditors like banks, credit card companies, hospitals, doctors, cell phone providers, and auto lenders for only pennies on the dollar. Once acquired, Portfolio Recovery Associates sues consumers to collect the full amount of the alleged debt.

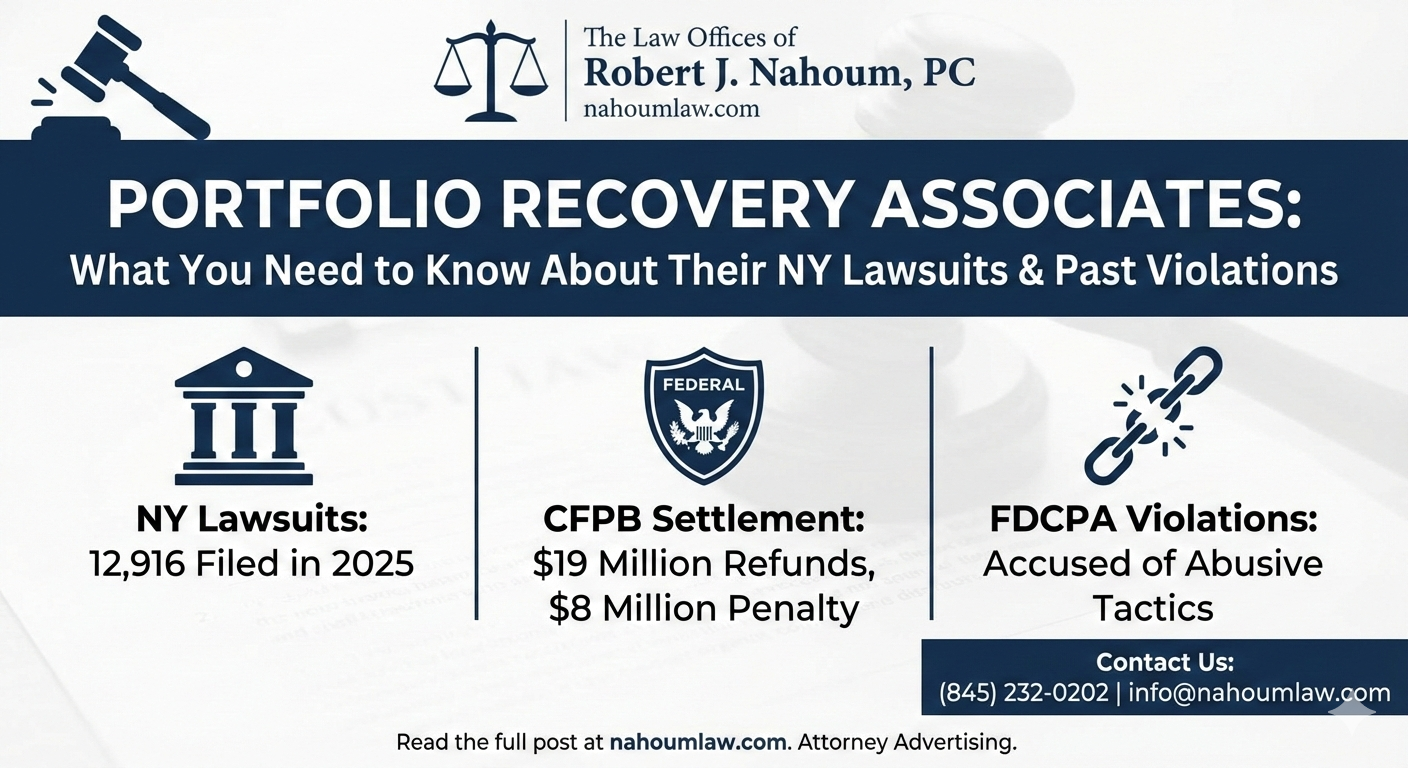

Portfolio Recovery Associates’ New York Lawsuits

According to the New York State Unified Court System, Portfolio Recovery Associates filed 12,916 debt collection lawsuits in New York in 2025 alone. These lawsuits often target consumers who may not even recognize the alleged debt or believe it was already resolved.

Past Violations and Government Enforcement

In 2015, Portfolio Recovery Associates reached a settlement with the federal Consumer Financial Protection Bureau (CFPB) after being accused of multiple illegal debt collection practices.

The CFPB alleged that Portfolio Recovery Associates:

- Misrepresented its intentions or ability to prove the debts it was suing over.

- Filed misleading, robo-signed court documents to accelerate lawsuits.

- Sued or threatened legal action on debts past the statute of limitations.

- Pressured consumers into payments based on false or deceptive claims.

- Claimed attorneys had reviewed cases or that lawsuits were imminent when they were not.

Under the CFPB settlement, Portfolio Recovery Associates was required to:

- Pay $19 million in refunds to consumers.

- Pay an $8 million penalty to the CFPB’s Civil Penalty Fund.

- Stop collecting on over $3 million of time-barred debt.

- Vacate judgments and dismiss pending lawsuits filed after the legal collection period.

Company Background

Portfolio Recovery Associates, LLC is a publicly traded company (NASDAQ: PRAA) headquartered at 120 Corporate Boulevard, Norfolk, VA 23502. The company is known for conducting debt collection calls from numbers such as:

- (800) 772-1413

- (800) 331-0500

- (866) 925-7109

- (800) 383-8013

FDCPA Violations and Consumer Rights

Portfolio Recovery Associates has repeatedly been accused of violating the Fair Debt Collection Practices Act (FDCPA) — the federal law designed to protect consumers from abusive and deceptive debt collection tactics. Under the FDCPA, third-party debt collectors are prohibited from using false, misleading, or harassing communication in connection with debt collection.

Consumers have the right to challenge collection lawsuits, demand debt validation, and, when appropriate, sue debt collectors who violate the law.

Legal Help for Debt Collection Defense

If you are being sued by Portfolio Recovery Associates or harassed by debt collectors, you do not have to face them alone. The Law Offices of Robert J. Nahoum, P.C. defends consumers in debt collection cases and helps negotiate fair resolutions throughout New York, New Jersey, and the Hudson Valley region.

Contact Us:

Law Offices of Robert J. Nahoum, P.C.

Brooklyn & Hudson Valley Offices

📞 (845) 232-0202

✉️ info@nahoumlaw.com