By: Robert J. Nahoum

Any reader of this blog knows I have been ringing the alarm on the threat and inequities of debt collection lawsuits for years. I and my consumer attorney colleagues are on the frontlines of this battle, day in and day out, on behalf of our clients, holding back the title wave of financial disruption debt collection lawsuits can cause.

A new report from the Pew Charitable Trusts confirms our warnings and provides some data to support our conclusions. According Erika Rickard, director of Pew’s civil legal modernization project “The courthouse has become a debt-collection toolâ€. The report reinforces what we already knew, pre-corona, debt collection lawsuits were the most common type of civil court case in many states.  The corona-economy will surely make this bad situation far far worse.

Here are some of the report’s key findings:

- Fewer people are using the courts for civil cases. Civil caseloads dropped more than 18 percent from 2009 to 2017. Although no research to date has identified the factors that led to this decline, previous Pew research shows lack of civil legal problems is not one of them: In 2018 alone, more than half of all U.S. households experienced one or more legal issues that could have gone to court, including 1 in 8 with a legal problem related to debt.

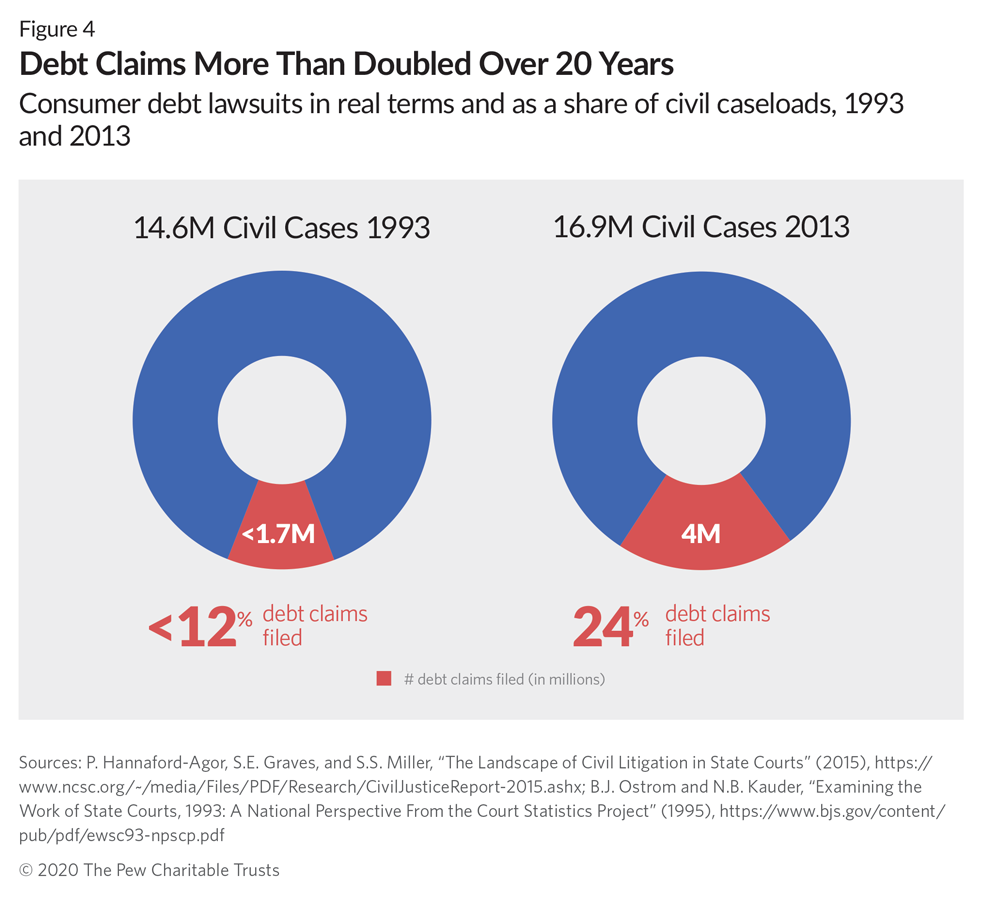

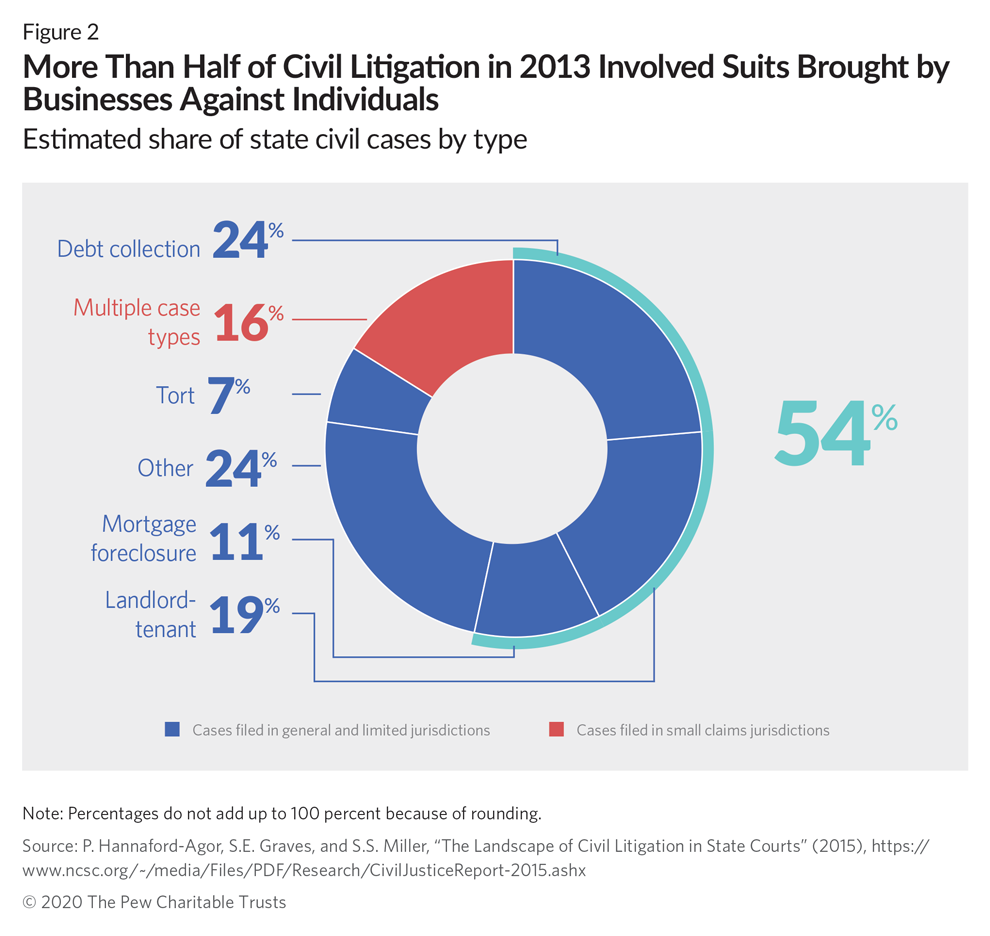

- Debt claims grew to dominate state civil court dockets in recent decades. From 1993 to 2013, the number of debt collection suits more than doubled nationwide, from less than 1.7 million to about 4 million, and consumed a growing share of civil dockets, rising from an estimated 1 in 9 civil cases to 1 in 4. In a handful of states, the available data extend to 2018, and those figures suggest that the growth of debt collections as a share of civil dockets has continued to outpace most other categories of cases. Debt claims were the most common type of civil case in nine of the 12 states for which at least some court data were available—Alaska, Arkansas, Colorado, Missouri, Nevada, New Mexico, Texas, Utah, and Virginia. In Texas, the only state for which comprehensive statewide data are available, debt claims more than doubled from 2014 to 2018, accounting for 30 percent of the state’s civil caseload by the end of that five-year period.

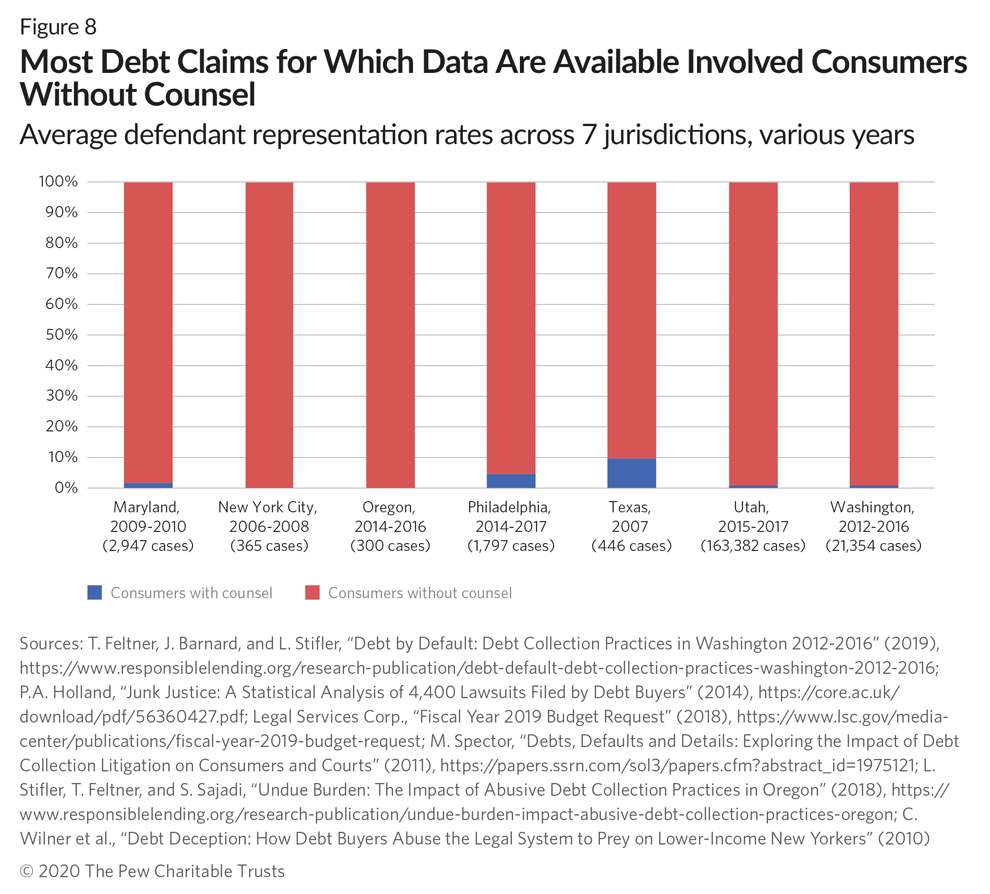

- People sued for debts rarely have legal representation, but those who do tend to have better outcomes. Research on debt collection lawsuits from 2010 to 2019 has shown that less than 10 percent of defendants have counsel, compared with nearly all plaintiffs. According to studies in multiple jurisdictions, consumers with legal representation in a debt claim are more likely to win their case outright or reach a mutually agreed settlement with the plaintiff.

- Debt lawsuits frequently end in default judgment, indicating that many people do not respond when sued for a debt. Over the past decade in the jurisdictions for which data are available, courts have resolved more than 70 percent of debt collection lawsuits with default judgments for the plaintiff. Unlike most court rulings, these judgments are issued, as the name indicates, by default and without consideration of the facts of the complaint—and instead are issued in cases where the defendant does not show up to court or respond to the suit. The prevalence of these judgments indicates that millions of consumers do not participate in debt claims against them.

My Take Away

I didn’t find any real revelations in the data. The report confirmed what I have been seeing and talking about for year. However, what did surprise and disappoint me was the apparent devoid of current data on New York debt collection cases. It looks like what few references there are to what is happening in New York is limited to decade-plus old data. From my perspective, many of the problem highlighted in the report are far worse here on the ground in New York State.

Also, I don’t see very much attention being paid to what is happening post-judgment. The majority of my defense practice is dealing with post judgment proceedings including wage garnishments and restrained bank accounts. Without data on these proceedings, an incomplete picture is being drawn on the severity of the problem. The pew report draws a bleak picture of what is happening in the debt collection courts. However, just as those of us on the front lines knew much of what the report concluded; we also know how much worse the problem really is.

If you need help settling or defending a debt collection lawsuit, stopping harassing debt collectors or suing a debt collector, contact us today to see what we can do for you. With office located in the Brooklyn and the Hudson Valley, the Law Offices of Robert J. Nahoum defends consumers in debt collection cases throughout the Tristate area including New Jersey.

The Law Offices of Robert J. Nahoum, P.C

(845) 232-0202

www.nahoumlaw.com