By: Robert J. Nahoum

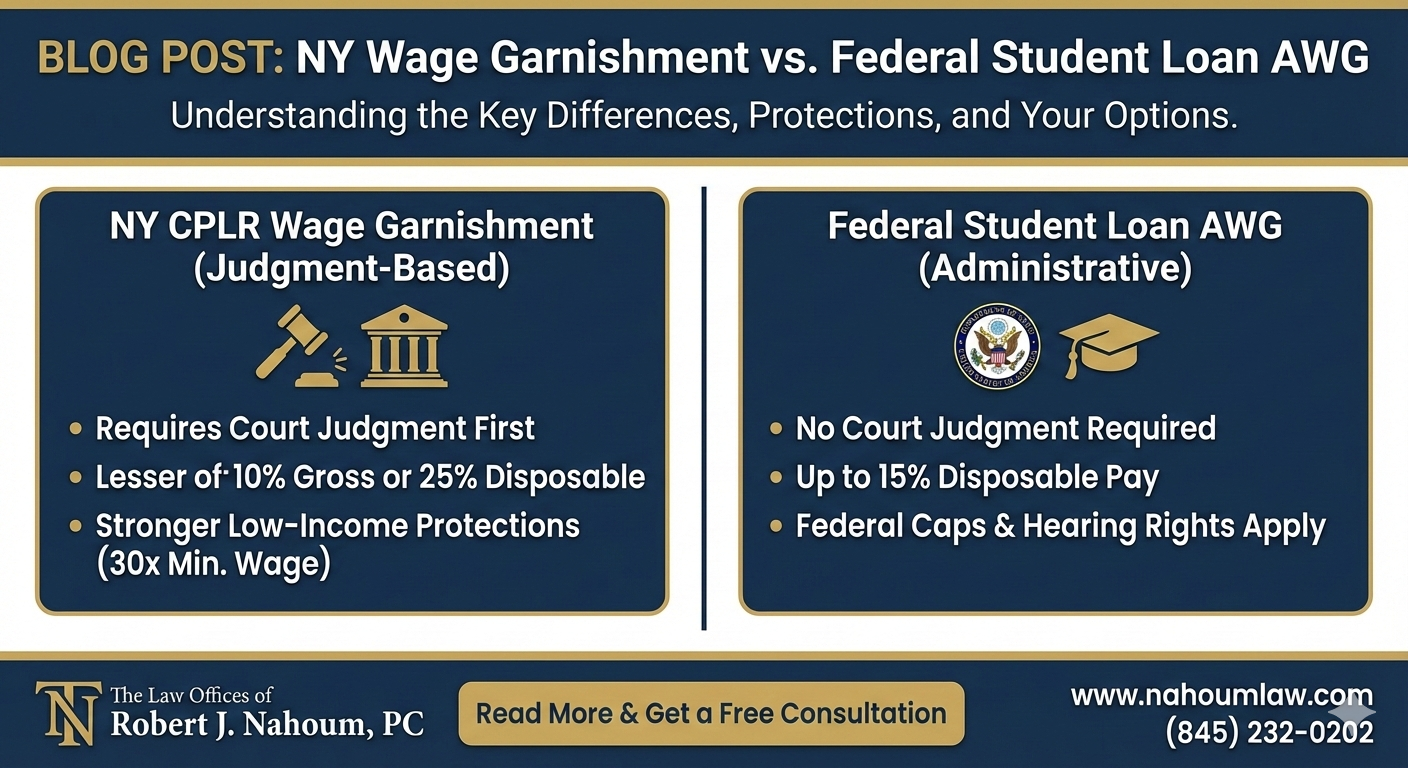

Wage garnishment for unpaid debts in New York is very different from federal administrative wage garnishment for defaulted federal student loans, especially in how the order is issued, how much can be taken, and what rights you have to challenge it. Understanding these differences helps New York consumers decide whether to fight the garnishment, negotiate, or look at options like bankruptcy or rehabilitation.

What is wage garnishment under New York CPLR?

Under New York Civil Practice Law and Rules (CPLR), most wage garnishments are called “income executions” and are issued after a creditor gets a court judgment against you. The sheriff or marshal serves the income execution, and your employer must withhold a portion of your paycheck and send it toward the judgment until it is paid or otherwise resolved.

Key features of New York CPLR wage garnishment:

- Requires a court judgment before wages can be garnished.

- Applies to most consumer debts (credit cards, medical, personal loans, etc.).

- Amount withheld is generally the lesser of:

- 10% of gross wages, or

- 25% of disposable earnings, and only to the extent earnings exceed 30× the applicable minimum wage.

If your disposable earnings are less than 30 times the federal or state minimum wage (whichever is higher), they cannot be garnished at all. New York’s formula is more protective than the baseline federal Consumer Credit Protection Act limits.

What is federal administrative wage garnishment for student loans?

Administrative wage garnishment (AWG) for federal student loans is a collection tool the U.S. Department of Education and its contractors can use after a loan goes into default, without first suing you in court. Instead of a judgment, the agency sends a wage garnishment order directly to your employer, instructing it to withhold part of your pay.

Key features of federal student loan AWG:

- No court lawsuit or judgment is required before garnishment starts.

- Your employer can be ordered to withhold up to 15% of your disposable pay.

- Total garnishments (student loans plus other orders) are capped by federal law at 25% of disposable earnings.

You must receive notice before AWG begins, with information about your right to request a hearing, object to the amount, claim hardship, or stop garnishment by entering rehabilitation or another resolution program. Your employer is prohibited from firing you because your wages are garnished for federal student loan debt.

How do New York CPLR wage garnishments and federal AWG differ?

Below is a comparison of New York judgment‑based wage garnishment under CPLR and federal administrative wage garnishment for defaulted federal student loans.

Key differences: NY CPLR vs. federal student loan AWG

| Issue / Feature | NY CPLR Wage Garnishment (Income Execution on Judgment) | Federal Administrative Wage Garnishment (Student Loans) |

| Legal basis | New York Civil Practice Law and Rules, including CPLR §5231 and related provisions. | Federal law allowing administrative collection of defaulted federal student loans and related regulations. |

| Need for court judgment? | Yes. Creditor must sue and obtain a New York judgment before garnishing wages. | No court lawsuit is required; the agency can order garnishment administratively. |

| Typical debts | Consumer and commercial judgments (credit cards, medical debt, personal loans, some private student loans, etc.). | Defaulted federal student loans (Direct, FFEL, some Perkins when held by the Department of Education or guaranty agencies). |

| Who issues the order? | Sheriff/marshal or support collection unit issues an income execution based on a New York judgment. | U.S. Department of Education or its collection contractor issues an AWG order to the employer. |

| Maximum percentage withheld | Lesser of 10% of gross wages or 25% of disposable earnings, and only to the extent pay exceeds 30× minimum wage. | Up to 15% of disposable earnings for the student loan garnishment, subject to an overall cap of 25% for all garnishments combined. |

| Protection for low‑income workers | If disposable earnings are below 30× the higher of federal or state minimum wage, wages cannot be garnished. | Federal minimum‑wage‑based limits apply; AWG order still may proceed but cannot exceed federal caps on disposable earnings. |

| Advance notice and hearing rights | You should receive notice of the lawsuit and then notice of the income execution; you can fight the judgment, assert exemptions, or seek to vacate a default. | You must receive written notice of intent to garnish and have the right to request a hearing, challenge the debt, or claim financial hardship before or shortly after garnishment begins. |

| How garnishment stops | Paying or settling the judgment, vacating the judgment, asserting exemptions, negotiating a modification, or discharging the debt in bankruptcy (when allowed). | Getting out of default (e.g., rehabilitation, consolidation, or certain repayment options), proving the debt is not owed or miscalculated, or showing undue hardship under the hearing process. |

| Employer’s obligations | Must follow New York income‑execution rules and limits; failure can expose the employer to liability under state law. | Must comply with federal AWG order, respond within set timeframes, and not terminate employment because of the garnish. |

FAQs for New York consumers facing wage garnishment

Can my wages be garnished twice: once under New York law and once for federal student loans?

Multiple garnishments are possible, but federal law caps the total amount that can be taken from your disposable earnings, generally at 25% in a given pay period. If you already have a New York income execution and a new student‑loan AWG order arrives, the employer must apply federal priority and cap rules when calculating the withholding.

Do New York’s garnishment limits protect me from federal student loan AWG?

Federal law generally preempts state limits for federal student loan administrative wage garnishment, so New York’s 10%‑of‑gross rule does not override the federal 15% AWG authority. However, overall federal caps on total garnishments still apply, and you may have separate federal hardship defenses that can reduce or suspend the student‑loan garnishment.

What if I never got notice before my wages were garnished?

If your wages are being taken under a New York CPLR judgment and you never knew about the case, you may have grounds to move to vacate a default judgment and stop the income execution. If the garnishment is for a federal student loan, you can request a review or hearing, argue that you did not receive proper notice, and seek to suspend or reverse the AWG while your challenge is considered.

If your wages are being garnished in New York—whether by a judgment creditor under the CPLR or through federal administrative wage garnishment for student loans—you should speak with an experienced New York consumer protection and debt collection defense lawyer to review your options, from challenging the judgment to negotiating, rehabilitating loans, or considering bankruptcy where appropriate.

The Law Offices of Robert J. Nahoum, P.C. defends consumers across New York in debt collection cases.

Contact us today at (845) 232-0202 or visit www.nahoumlaw.com for a free consultation.

Disclaimer: This post provides general information and does not constitute legal advice. Laws regarding minimum wage and exemptions are subject to change; always consult with an attorney regarding your specific case.