By: Robert J. Nahoum

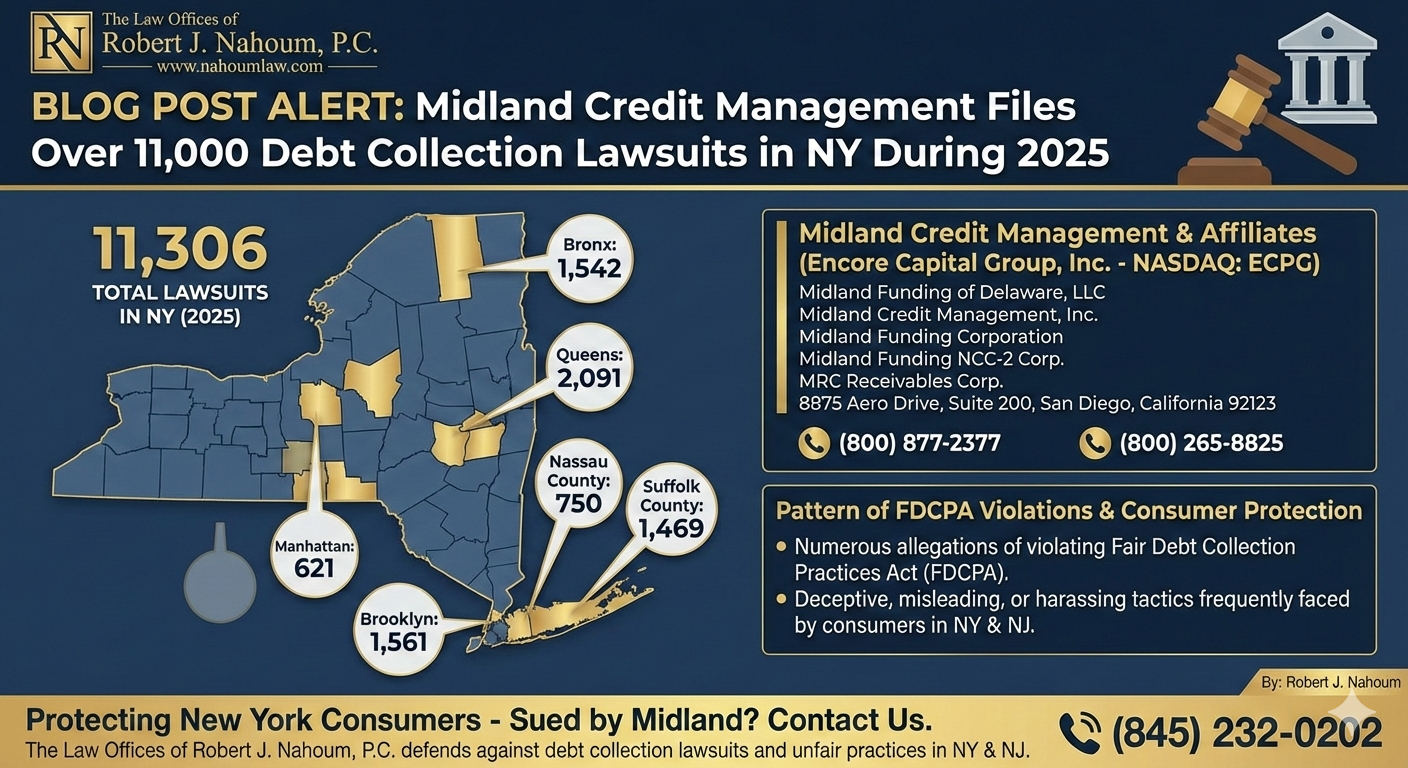

According to data from the New York State Unified Court System, Midland Credit Management—one of the nation’s largest junk debt buyers—filed 11,306 debt collection lawsuits in New York during 2025. These lawsuits targeted consumers in nearly every county, including 1,542 cases in the Bronx, 1,561 in Brooklyn, 750 in Nassau County, 621 in Manhattan, 2,091 in Queens, and 1,469 in Suffolk County.

Midland Credit Management and its affiliated companies—Midland Funding of Delaware, LLC, Midland Credit Management, Inc., Midland Funding Corporation, Midland Funding NCC‑2 Corp., and MRC Receivables Corp.—are all subsidiaries of Encore Capital Group, Inc. (NASDAQ: ECPG), a publicly traded debt collection company headquartered in San Diego, California.

These companies often contact consumers from phone numbers (800) 877‑2377 and (800) 265‑8825, using the address: 8875 Aero Drive, Suite 200, San Diego, California 92123.

Pattern of FDCPA Violations

Midland and its affiliates have faced numerous allegations of violating the Fair Debt Collection Practices Act (FDCPA)—the federal law that prohibits third‑party debt collectors from using deceptive, misleading, or harassing tactics. Consumers across New York and New Jersey frequently sue Midland for these violations, highlighting ongoing issues in how the company pursues old or purchased debts.

Protecting New York Consumers

If you’ve been sued by Midland Credit Management or Midland Funding, or are receiving collection calls or letters, you have legal rights. The Law Offices of Robert J. Nahoum, P.C. defends consumers against debt collection lawsuits, challenges unfair collection practices, and helps negotiate or settle claims throughout New York and New Jersey.

Contact our offices in Brooklyn or Rockland County to schedule a consultation:

📞 (845) 232‑0202