By: Robert J. Nahoum

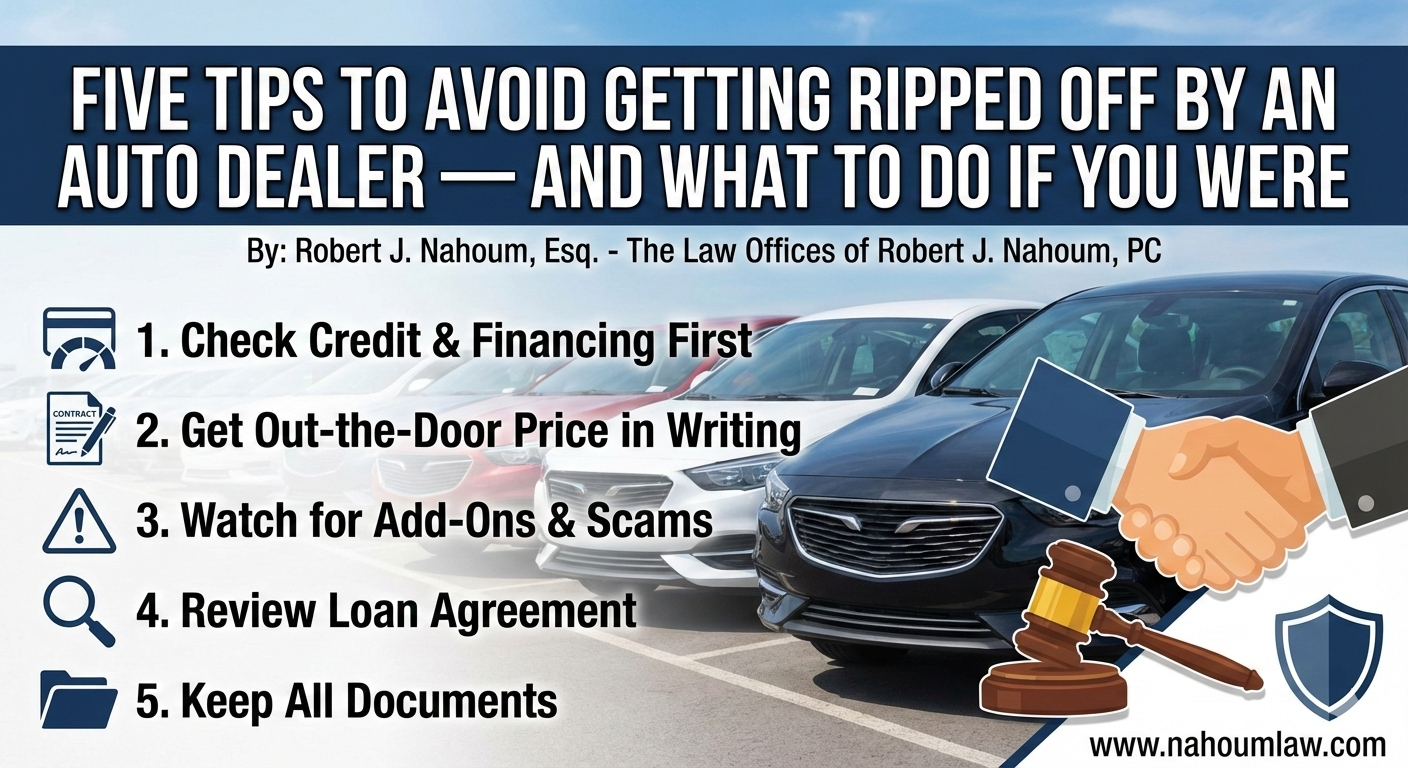

Buying a car should be exciting, not stressful. Unfortunately, some auto dealers take advantage of buyers through hidden markups, fake financing promises, or misleading disclosures. As a New York/ New Jersey consumer protection and auto fraud lawyer, I’ve helped many clients recover when they were deceived. Here are five tips to avoid getting ripped off by an auto dealer—and what to do if you think you already were.

- Check Your Credit and Financing Options First

Before visiting a dealership, know your credit score and get pre‑approved for financing through a bank or credit union. Dealers often inflate interest rates or add hidden loan fees. By arriving with pre‑approved financing, you can compare offers and avoid pressure tactics.

- Ask for the Out-the-Door Price in Writing

Dealers sometimes advertise one price and charge another. Request a written “out‑the‑door” price that includes all taxes, fees, and extras. Review the sales contract carefully before signing, and take your time, no legitimate dealer should rush you.

- Watch Out for Add‑Ons and Spot Delivery Scams

Be cautious about extended warranties, GAP coverage, or protection packages added without clear consent. Also beware of “yo‑yo” or spot delivery scams, where a dealer lets you take the car home before financing is finalized, then demands higher payments later. If this happens, contact an auto fraud attorney in New York immediately.

- Review Your Loan Agreement for Truth in Lending Act Disclosures

The Truth in Lending Act (TILA), a federal law, requires lenders and dealers to clearly disclose financing terms such as the annual percentage rate (APR), total finance charges, and payment schedule before you sign. If these disclosures were inaccurate, missing, or misleading, you may have a legal claim. Understanding these details helps prevent unfair loan practices.

- Keep Copies of All Documents and Communications

Never leave the dealership without signed copies of every document you signed or were shown. Keep a record of all texts, emails, and ads you relied upon, these can be essential if a dispute arises.

What to Do If You Were Ripped Off

If you suspect you were misled by an auto dealer, take action right away:

- Gather all paperwork, including your sales contract, loan documents, and dealer communications.

- Do not return the car or stop payments without legal advice.

- Contact a consumer protection lawyer who handles auto fraud. Our firm helps clients across New York expose dealer misconduct, cancel fraudulent deals, and recover damages. Learn more about our Auto Fraud Legal Services.

How the Law Protects You

Consumer protection laws like TILA, the Magnuson‑Moss Warranty Act, and New York’s General Business Law §349 provide tools to fight back against unfair or deceptive acts by auto dealers. A knowledgeable attorney can help you assert your rights, negotiate fair resolutions, or pursue claims in court if necessary.

Bottom Line:

You don’t have to accept being taken advantage of by a dishonest auto dealer. By following these five steps and knowing your rights under the Truth in Lending Act, you can protect your finances and your peace of mind.

If you believe a car dealer misled or overcharged you, contact The Law Offices of Robert J. Nahoum, P.C. for a free consultation. We’ll review your case and help you understand your options for relief.

At The Law Offices of Robert J. Nahoum, P.C., we represent consumers across New York and New Jersey who have been misled or exploited in auto sales and financing. Our firm investigates GAP insurance overcharges, hidden fees, and other forms of auto dealer fraud. We fight to recover money that should never have been taken in the first place.

If you suspect your car dealer took advantage of you through GAP insurance, contact us for a free consultation to understand your rights and options.

📞 Call (845) 232‑0202 or visit our contact page: www.nahoumlaw.com/contact