By: Robert J. Nahoum

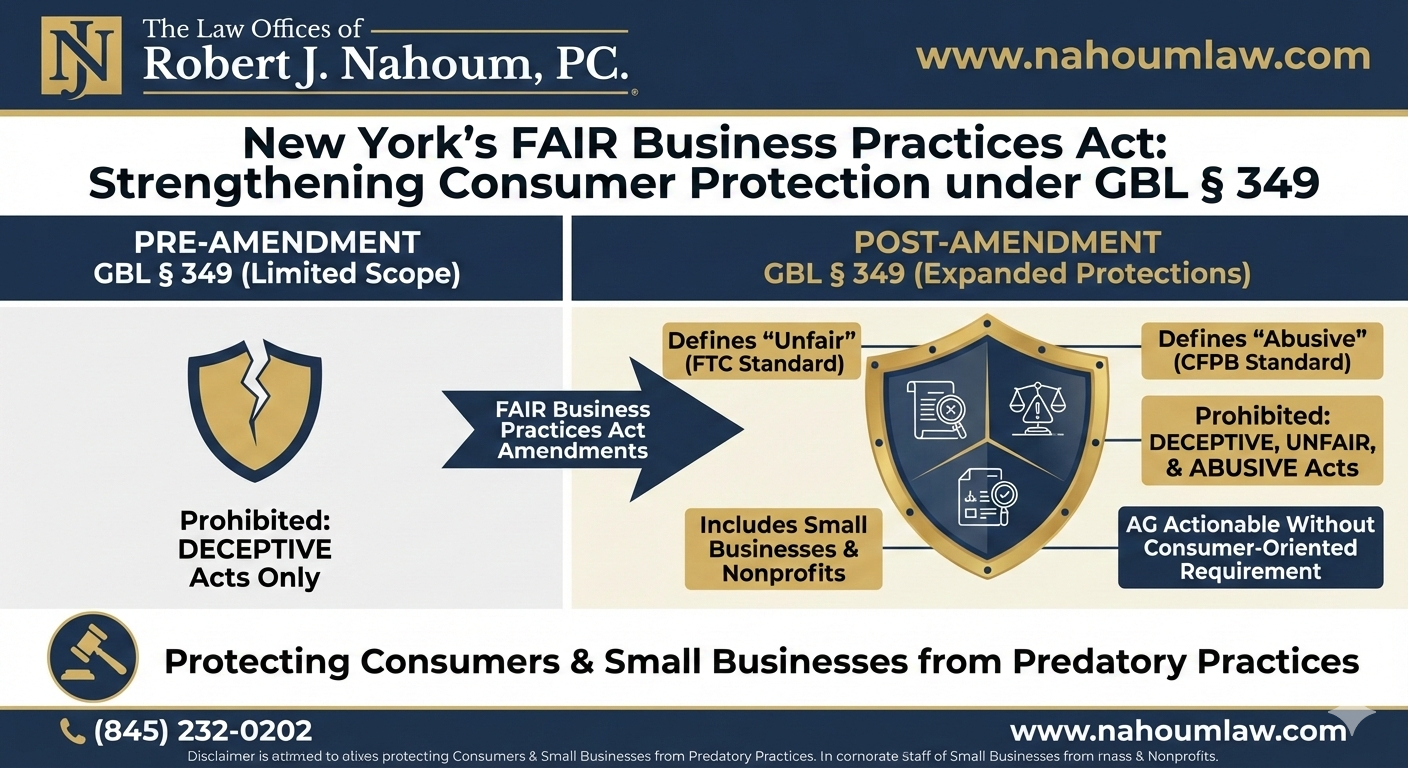

Key amendments to NY GBL § 349 under the FAIR Business Practices Act.

Amendments to NY GBL § 349

| Aspect of GBL § 349 | Pre‑Amendment Rule / Post‑Amendment Rule |

| Scope of prohibited conduct | – Pre: Prohibited only deceptive acts or practices that mislead or are likely to mislead reasonable consumers. – Post: Explicitly prohibits deceptive, unfair, and abusive acts or practices, significantly expanding the reach of § 349. |

| Definition of “unfair” practices | – Pre: No statutory definition of “unfair”; enforcement and private claims focused on deception. – Post: “Unfair” defined in line with the FTC Act: conduct causing or likely to cause substantial injury that is not reasonably avoidable and not outweighed by countervailing benefits to consumers or competition. |

| Definition of “abusive” practices | – Pre: No “abusive” standard; abusive conduct had to be framed as deceptive or under other statutes. – Post: “Abusive” defined using a CFPB‑style standard, including conduct that materially interferes with understanding terms or takes unreasonable advantage of a person’s lack of understanding, inability to protect their interests, or reasonable reliance on the business. |

| Consumer‑oriented requirement (AG enforcement) | – Pre: Courts imposed a “consumer‑oriented” requirement, limiting many § 349 actions to conduct affecting the public at large or recurring patterns. – Post: Statute makes prohibited acts “actionable by the attorney general regardless of whether or not” they are consumer‑oriented, expressly displacing that judicial doctrine for AG enforcement. |

| Coverage of businesses and nonprofits | – Pre: Applied primarily to consumer‑facing conduct; protection of businesses and nonprofits was uncertain and often litigated. – Post: Text and commentary emphasize that protections extend to other businesses and nonprofits where they are targets of unfair, abusive, or deceptive practices. |

| Relationship to federal standards | – Pre: § 349 developed largely through New York case law, with only indirect reference to federal standards. – Post: Definitions of “unfair” and “abusive” expressly draw from the FTC Act and the Consumer Financial Protection Act, aligning New York with federal UDAP/UDAAP frameworks while in some respects going further. |

What is the FAIR Business Practices Act?

- The FAIR Business Practices Act (Fostering Affordability and Integrity through Reasonable Business Practices Act) is a new law signed by Governor Kathy Hochul that updates New York’s primary consumer protection statute, General Business Law §349, for the first time in 45 years.

- Championed by Attorney General Letitia James and sponsored by Senator Leroy Comrie and Assemblymember Micah Lasher, the Act targets unfair, abusive, and deceptive business practices that increase costs for New Yorkers.

Why did New York change its consumer protection law?

- State leaders emphasized that New York previously had one of the weakest consumer protection laws in the country, leaving families and small businesses vulnerable to abusive practices.

- The Act was designed to address rising costs, deceptive financing schemes, and abusive contract terms that have pushed individuals and small businesses into insolvency and legal battles they often cannot afford.

Who is protected under the FAIR Business Practices Act?

- The Act protects individual consumers as well as small businesses from unfair, abusive, and deceptive business practices in New York.

- Legislators highlighted that small businesses, like individual consumers, have faced predatory lending and unfair contract provisions, and the new law aims to provide meaningful remedies for both.

What kinds of conduct does the Act target?

- The law is aimed at predatory lenders, abusive debt collectors, dishonest mortgage servicers, and other companies that engage in unfair, abusive, or deceptive conduct.

- It seeks to reduce junk fees and other hidden or misleading charges that drive up costs for working families and small businesses.

How does this change General Business Law §349?

- The FAIR Business Practices Act modernizes GBL §349 by codifying key case law and expanding enforcement tools so that unfair and abusive practices, not just deceptive conduct, can be effectively challenged.

- These updates give enforcers and private litigants clearer grounds to hold bad actors accountable and improve transactional safety in the marketplace.

How will this help with debt collection and lending abuses?

- Attorney General James has specifically noted that the updated law will be used to stop predatory lenders and abusive debt collectors that drain billions from hardworking New Yorkers each year.

- By strengthening the standard for what counts as unlawful conduct, the Act can complement federal laws like the Fair Debt Collection Practices Act and other consumer statutes frequently used in private enforcement.

What does this mean for small businesses?

- Small businesses have often faced deceptive financing schemes and one-sided contract terms, and the Act is intended to “maintain transactional safety” for these entities as well as individual consumers.

- Legislators explained that the law gives enforcement officials better tools to hold bad actors accountable so that honest businesses can compete on a fair playing field.

How does the Act relate to affordability in New York?

- State officials describe the FAIR Business Practices Act as an affordability measure because stopping unfair and abusive practices helps families keep more of what they earn and reduces unnecessary fees and charges.

- The law is part of a broader effort by New York to “stand up and fight back” against practices that raise the cost of living for working people and small businesses.

How can consumers and small businesses use these new protections?

- New Yorkers who believe they have been harmed by unfair, abusive, or deceptive practices may have stronger claims under the updated GBL §349 and can pursue relief through enforcement agencies or private lawsuits.

- These claims often work alongside other consumer protection tools, including federal laws such as the Fair Debt Collection Practices Act, Truth in Lending, and other statutes commonly used in consumer litigation.

How The Law Offices of Robert J. Nahoum, P.C. can help

- The Law Offices of Robert J. Nahoum, P.C. is a New York consumer protection law firm representing individuals and small businesses in cases involving deceptive sales, unfair debt collection, identity theft, auto fraud, and other unfair business practices.

- The firm regularly litigates consumer protection claims under state and federal law and can evaluate whether the FAIR Business Practices Act and updated GBL §349 provide additional remedies in your situation.

If you believe you have been the victim of unfair, abusive, or deceptive business practices in New York, contact The Law Offices of Robert J. Nahoum, P.C. to discuss your rights and options under the FAIR Business Practices Act and other consumer protection laws.

Contact us today at (845) 232-0202 or visit www.nahoumlaw.com for a free consultation.

Disclaimer: This post provides general information and does not constitute legal advice. Laws regarding minimum wage and exemptions are subject to change; always consult with an attorney regarding your specific case.