By: Robert J. Nahoum

Anyone who has ever been sued in a debt collection lawsuit should be familiar with the court documents collectively referred to as the “summons and complaintâ€. The two documents have become almost interchangeably viewed as one document but in reality, they are two documents with two distinct purposes.

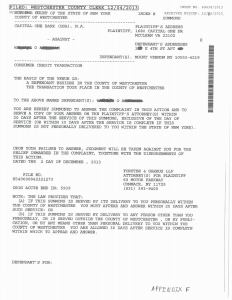

The summons is document which advises you that you have been sued, in what court you were sued, how much time you have to answer the lawsuit and warns that if you don’t answer; a default judgment will be entered against you.  In order for the court to obtain personal jurisdiction over you, the summons must be served on you or another adult in your home personally or if attempt at personal service fail, by posting a copy to the door of your home and mailing a copy.

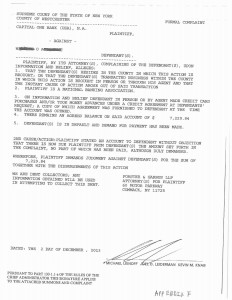

The complaint is the document were the debt collector alleges the facts giving rise to its claim. The allegations of the complaint must be proven by the debt collector and must come together to plead all the necessary elements of a recognized theory or “cause of action†under the law. For example, in a credit card debt collection case where the debt collector is pleading a breach of contract cause of action, the debt collector would have to plead (1) that you entered into a credit card agreement, (2) that you used the credit card and (3) that you failed to pay the credit card charges.

It is the standard practice to serve the complaint on the defendant at the same time as the summons. This practice is so customary that the two documents are now essentially referred to collectively. In fact, in some debt collection courts including the Civil Court of the City of New York, many debt collectors take advantage of an expedited document called an “endorsed complaintâ€. The endorsed complaint actually combines the summons and complaint into one single document.

What is most important to know about the summons and complaint is that they cannot be ignored. If you get served, doing nothing will only make things worse guaranteeing the debt collector a default judgment. With a default judgment in place, the debt collector can freeze your bank accounts and garnishee your wages.

If you need help settling or defending a debt collection law suit, stopping harassing debt collectors or suing a debt collector, contact us today to see what we can do for you.

The Law Offices of Robert J. Nahoum, P.C

(845) 232-0202

www.nahoumlaw.com

info@nahoumlaw.com