By: Robert J. Nahoum

The Problem:

You have been sued by a debt collector and have come to terms on a settlement but the debt collector wants you to sign something called a “stipulationâ€. What is a stipulation in a New York Debt Collection Case?

The Rules:

Under most circumstances, the procedural rules in a New York debt collection lawsuit is called the New York Civil Practice Laws and Rules (CPLR for short). CPLR section 2104 says:

“An agreement between parties or their attorneys relating to any matter in an action, other than one made between counsel in open court, is not binding upon a party unless it is in a writing subscribed by him or his attorney or reduced to the form of an order and entered.â€

What this basically means is that the parties to a lawsuit can agree to anything in the case and that agreement will be binding so long as it is memorialized in a written document. That document is the stipulation.  Stipulations are used for a variety of things including adjournments of court deadlines, vacatur of default judgments, dismissal of cases and the settlement of disputes (called a “Stipulation of Settlementâ€).

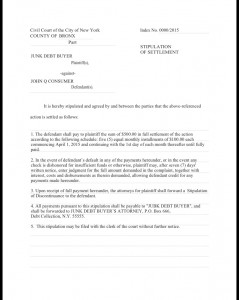

The basic terms of a Stipulation of Settlement include the (1) amount of the settlement, (2) the schedule of payments, (3) how payments are to be made and delivered, (4) the consequences for default, and (5) what happens when the settlement has been paid.

The basic Stipulation of Settlement looks like this:

If you need help settling or defending a debt collection law suit, stopping harassing debt collectors or suing a debt collector, contact us today to see what we can do for you. With office located in the Bronx, Brooklyn and Rockland County, the Law Offices of Robert J. Nahoum defends consumers in debt collection cases throughout the Tristate area including New Jersey.

The Law Offices of Robert J. Nahoum, P.C

(845) 232-0202

www.nahoumlaw.com